Geothermal Weekly - #8

Constellation's newest Acquisition, Trump's turbulence, and Innovation in heating and cooling

📢 Upcoming Webinars/Webcasts/Auctions

Ormat Technologies, Inc. (NYSE: ORA), a leading geothermal and renewable energy company, plans to publish its fourth quarter and full year 2024 financial results in a press release that will be issued on Wednesday, February 26, 2025, after the market closes. In conjunction with this report, the Company has scheduled a conference call to discuss the results at 10:00 a.m. ET on Thursday, February 27, 2025.

Polaris Renewable Energy Inc. (TSX:PIF) ("Polaris" or the "Company") is pleased to announce it will be holding its Earnings Conference Call and Webcast to report its Q4 and annual 2024 Earnings Results on Thursday, February 20th, 2025, at 10:00 am EST. Click here to sign up for the webcast.

The BLM has scheduled geothermal lease sales for 15 parcels on April 8th, 2025. Over 50,800 acres on public lands in Utah’s Beaver, Iron and Sevier counties will be up for 10-year extendable leases for resource explore for and development. You can view more on the auction here.

🤝 Constellation’s $16.4B Calpine Deal: What It Means for Geothermal

What’s happening

Constellation Energy (CEG) is acquiring Calpine Corp for $16.4 billion, bringing the total transaction value (including debt) to $26.6 billion. The move makes CEG the largest independent power provider in the U.S., adding 60 GW of generation capacity from nuclear, natural gas, and geothermal sources. The deal is fueled by rising AI-driven energy demand and is expected to boost Constellation’s free cash flow by $2 billion annually.

Why it matters for geothermal

CEG now controls The Geysers, the largest geothermal complex in the world and providing 10% of California’s clean energy, marking a major expansion into the sector.

Geothermal investment could accelerate as CEG integrates Calpine’s assets and expands its low-carbon portfolio.

New geothermal PPAs signal demand: Ormat signed a 10-year, up to 15MW PPA with Calpine Energy Solutions, showing growing corporate interest in baseload renewables.

Innovation potential: The deal could spur R&D in superhot rock and enhanced geothermal systems (EGS) as part of broader clean energy initiatives.

Big picture for energy

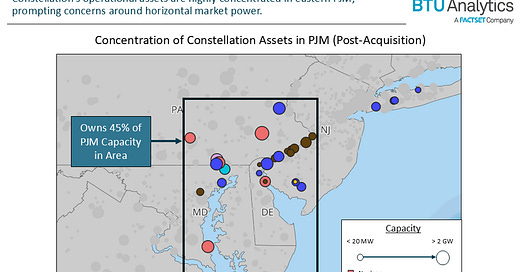

Market power concerns: With 12.2% of PJM, 11% of ERCOT, and 9.2% of CAISO capacity, regulatory scrutiny over competition and pricing is likely.

AI-driven energy demand: The deal positions CEG to capitalize on rapid electricity demand growth from data centers, Bitcoin mining, and industrial expansion.

Strategic clean energy play: CEG is doubling down on nuclear, geothermal, and battery storage, reinforcing its position as a leader in dispatchable, low-carbon power.

Divestitures ahead? Regulators may require CEG to sell assets in key markets to limit its influence over wholesale electricity pricing.

What to watch

Will Constellation expand geothermal further? This could signal a shift in how major utilities view geothermal’s role in the clean energy mix.

How will regulators respond? Market concentration could lead to asset sales or stricter oversight of pricing strategies.

More corporate PPAs? If companies like Ormat continue signing long-term contracts with retail suppliers like Calpine Energy Solutions, geothermal could see a surge in financing and development.

⚡️ Biden Out, Trump In: What’s Next for Geothermal Energy?

What’s happening

The transition from Biden to Trump is setting the stage for a major energy policy shift, with fossil fuel expansion, shifting clean energy priorities, and lingering uncertainty about federal funding stability.

Biden’s final move: An Executive Order directing the DOE and DOI to fast-track leasing of federal land for AI-driven clean energy projects, including at least five new "Priority Geothermal Zones” by the end of 2027.

Trump’s reversal: Within days of taking office, Trump froze IRA clean energy funding, and it remains frozen despite the rescinding of other freezes after legal challenges and market backlash. However, the pause created lasting uncertainty for how the administration will handle clean energy moving forward.

Chris Wright as Energy Secretary: The Liberty Energy CEO and longtime fossil fuel champion takes over the DOE with a focus on energy expansion, deregulation, and an “all-of-the-above” strategy favoring nuclear, gas, and geothermal.

Why it matters for geothermal

New federal leasing opportunities: Biden’s order mandates new geothermal lease sites on federal land, potentially opening prime drilling areas—but Trump’s follow-through remains unclear.

Less competition from wind: The offshore wind leasing moratorium could shift federal clean energy priorities toward geothermal and nuclear, especially for AI-driven energy projects.

Chris Wright’s bullish stance on geothermal: In his confirmation hearing, Wright emphasized the need for ‘pragmatic’ energy expansion and signaled support for geothermal as part of the U.S. energy mix.

Regulatory easing: With Wright at DOE, expect faster permitting and fewer bureaucratic barriers for geothermal drilling, mirroring the broader push for deregulation.

Big picture for energy

LNG dominance, renewables uncertainty: Trump’s push to increase LNG exports could divert investment away from renewables, but geothermal—a baseload energy source—could still benefit.

Infrastructure bottlenecks remain: Even with support, transmission grid expansion and interconnection delays could limit geothermal growth unless the administration tackles permitting reform.

Federal funding stability is in question: The freeze on IRA funds is continuing to send shockwaves through the clean energy industry. While geothermal funding wasn’t permanently cut, uncertainty lingers about how predictable DOE support will be under this administration.

What to watch

Will Trump follow through on geothermal leasing? The new "Priority Geothermal Zones" could be a major opportunity—if they aren’t quietly shelved.

How much DOE funding actually flows? Despite Wright’s stated support for geothermal, broader clean energy spending could continue to face roadblocks.

Can geothermal gain traction in AI energy plans? With data center energy demand skyrocketing, geothermal’s reliability gives it a competitive edge in securing energy contracts.

🔥 New innovations catching fire

The geothermal heating and cooling sector is experiencing significant investments and technological advancements aimed at reducing costs and expanding adoption for heating, cooling, and power generation.

Bedrock Energy raised $12 million in a Series A to scale geothermal heating and cooling in the U.S., utilizing tech-driven borefield design to cut installation costs and improve efficiency. The round was led by Titanium Ventures. Energy Impact Partners and Sustainable Future Ventures joined alongside existing investors Wireframe Ventures, Overture Ventures, Toba Capital, Elemental Impact, First Star Ventures, and Cantos.

Borobotics secured CHF 1.3 million (approximately $1.4 million USD) in pre-seed funding to develop its autonomous "worm" drill, which could make geothermal heat pumps viable in backyards, parking lots, and basements—lowering installation barriers for small-scale geothermal. The round was led by Underground Ventures based in Copenhagen, the world’s first VC dedicated entirely to funding geothermal tech startups.

Strataphy launched a Cooling-as-a-Service model, removing upfront costs for businesses looking to adopt geothermal cooling, with early projects in the MENA region and plans to expand to the U.S.

📝 Other Notes:

As of January 15th, 2025, the Bureau of Land Management has finalized a new categorical exclusion (CX) that simplifies the permitting process for geothermal drilling in public lands in the United States. Based on analysis done by the US Department of Energy, the categorical exclusion can shorten permitting times by up to 1 year, significantly reducing capital costs for geothermal projects.

The U.S. Department of Energy’s ARPA-E has launched the $30 million SUPERHOT program to advance superhot geothermal energy, aiming to unlock 10-20 GW of baseload power by developing high-temperature well designs, novel materials, and advanced heat extraction methods capable of withstanding 375°C+ conditions, building on past support for industry leaders like Fervo Energy, AltaRock, and Eden Geopower.

Congresswoman Ocasio-Cortez reintroduces the Geothermal Cost-Recovery Authority Act in which would “expand the Geothermal Steam Act of 1970 to give the Department of the Interior the authority to collect certain fees from holders of geothermal leases through September 30, 2031. Specifically, Interior may direct those leaseholders to reimburse the United States for costs from (1) processing applications for geothermal leases on federal land, such as applications for geothermal drilling permits; and (2) monitoring geothermal exploration and development activities, including reclamation activities. Interior may reduce the amount of the fee if it determines that (1) the full reimbursement would impose an economic hardship on the leaseholder, or (2) a less than full reimbursement is necessary to promote the greatest use of geothermal resources.”

The U.S. Department of Energy’s Loan Programs Office (LPO) announced on January 15 a conditional commitment to SPV ESM ATLiS LLC (ATLiS), a subsidiary of EnergySource Minerals LLC (ESM), for a direct loan of up to $1.36 billion ($1.22 billion of principal plus $141 million of capitalized interest) to finance the construction, equipping, and operation of a facility in California to produce lithium hydroxide from geothermal brine.

A geothermal lease sale being prepared for Augustine Volcano site in Alaska. An announcement on timing and other key details is expected for early spring.

A new NREL study found that federal lands hold significant geothermal potential, with up to 975 GW of enhanced geothermal capacity available for development on 27 million acres. While only a small fraction of federal land (less than .5%) is needed to meet future energy demands, the Bureau of Land Management, U.S. Forest Service, and Department of Defense hold the greatest potential for geothermal projects, highlighting key opportunities for expansion in the push toward carbon-free electricity by 2035.

Trump’s decision to withdraw the U.S. from the Paris Agreement has drawn sharp criticism from EU leaders, with German Economy Minister Robert Habeck calling it the “beginning of historic failure” and European Commission President Ursula von der Leyen reaffirming Europe’s commitment to global climate action. At the World Economic Forum, von der Leyen emphasized that clean energy—including geothermal, fusion, and advanced battery storage—is central to Europe’s energy independence and economic competitiveness, with a new plan set to be unveiled in February to accelerate the EU’s clean energy transition.

Thorney Technologies Ltd has increased its stake in Terragen Holdings Ltd from 6.09% to 7.28% through a placement and rights issue, after Terragen raised $1.54 million from a fully underwritten entitlement offer to fund scientific research, global expansion, and working capital.

Guinness Asset Management LTD decreased its holdings in Ormat Technologies, Inc. (NYSE:ORA - Free Report) by 26.3% in the 4th quarter. The firm owned 265,567 shares of the energy company's stock after selling 95,002 shares during the quarter. Guinness Asset Management LTD owned 0.44% of Ormat Technologies worth $17,987,000 at the end of the most recent reporting period. Hedge funds and other institutional investors own 95.49% of the company's stock.

Other movements among other investors have occurred in the last few weeks

US-based geothermal association Geothermal Rising expands into Canada with acquisition of CanGEA. CanGEA will be known as Geothermal Rising Canada

Star Energy Geothermal, a leading Indonesian geothermal developer and subsidiary of PT Barito Renewables Energy, is partnering with global energy technology company SLB to enhance geothermal efficiency and economics through advanced subsurface characterization, AI-driven well placement, and optimized drilling techniques. With 886 MW of installed geothermal capacity, Star Energy aims to increase recovery rates and improve project economics, leveraging SLB’s expertise to overcome technical challenges and unlock greater geothermal potential.

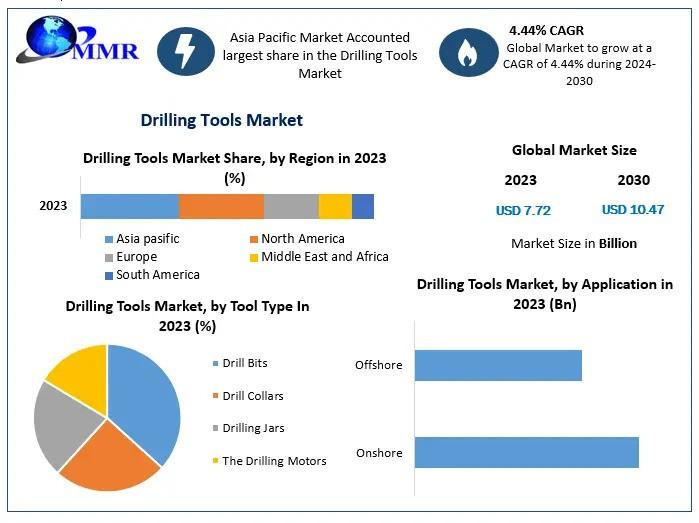

The Drilling Tools Market was valued at US$ 7.72 Bn in 2023 and is expected to reach US$ 10.47 Bn by 2030, at a CAGR of 4.44% during a forecast period.

Getech Group saw a 17% revenue increase in 2024 due to energy transition exploration. The company is diversifying into natural hydrogen and geothermal energy to enhance market position. You can read more here.